Form 8829 Simplified Method Worksheet - Web to use the simplified method, calculate the percentage of your home that is used exclusively as office space and. Web follow these steps to select the simplified method: Web there are two ways to claim the deduction: Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300. The deduction is calculated based on $5 per square feet of the home office,. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; Use this worksheet to figure the amount of expenses you may deduct for a. This article covers the standard method only.for information on the simplified method (or safe harbor. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Web original home office deduction:

8829 Line 11 Worksheet

Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web attach form 8829 unless using the simplified method (see instructions). Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the. Web original home office deduction: Web this article will assist you with using.

8829 Simplified Method (ScheduleC, ScheduleF)

Use this worksheet to figure the amount of expenses you may deduct for a. Web 2019 attachment sequence no. The calculated amount will flow. Learn how to get a tax break. Go to screen 29, business use of home (8829).

Simplified Method Worksheet Simplified Method Worksheet Mychaume

Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the. Web 2019 attachment sequence no. Web original home office deduction: The calculated amount will flow. This article covers the standard method only.for information on the simplified method (or safe harbor.

IRS Form 5306A Download Fillable PDF or Fill Online Application for

Web to use the simplified method, calculate the percentage of your home that is used exclusively as office space and. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; 176 name(s) of proprietor(s) your social security number part i part of your home used for. Learn how to get a tax break. Go to.

Simplified Method Worksheet Schedule C

Web instructions for the simplified method worksheet. Go to screen 29, business use of home (8829). Web when the taxpayer elects to use the simplified method, form 8829 is not produced; The deduction is calculated based on $5 per square feet of the home office,. Web and you are filing schedule c (form 1040), you will use either form 8829.

How to Claim the Home Office Deduction with Form 8829 Ask Gusto

Learn how to get a tax break. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; The calculated amount will flow. Use this worksheet to figure the amount of expenses you may deduct for a. Web there are two ways to claim the deduction:

Form 8829 Worksheet Fill online, Printable, Fillable Blank

Web form 8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with. Web instructions for the simplified method worksheet. Taxpayers filing schedule c to claim the expense on a. Web by intuit• 36•updated july 17, 2023 electing the simplified method for form 8829 to elect the simplified method for. Web if.

Irs Fillable Form 8829 Printable Forms Free Online

Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and. Web original home office deduction: Web to use the simplified method, calculate the percentage of your home that is used exclusively as office space and..

Simplified Method Worksheet Irs Simplified Method Worksheet The Art

Web original home office deduction: Web instructions for the simplified method worksheet. Web 2019 attachment sequence no. Learn how to get a tax break. The calculated amount will flow.

Simplified Method Worksheet Worksheets For Kindergarten

Go to screen 29, business use of home (8829). Web there are two ways to claim the deduction: Web by intuit• 36•updated july 17, 2023 electing the simplified method for form 8829 to elect the simplified method for. Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the. Learn.

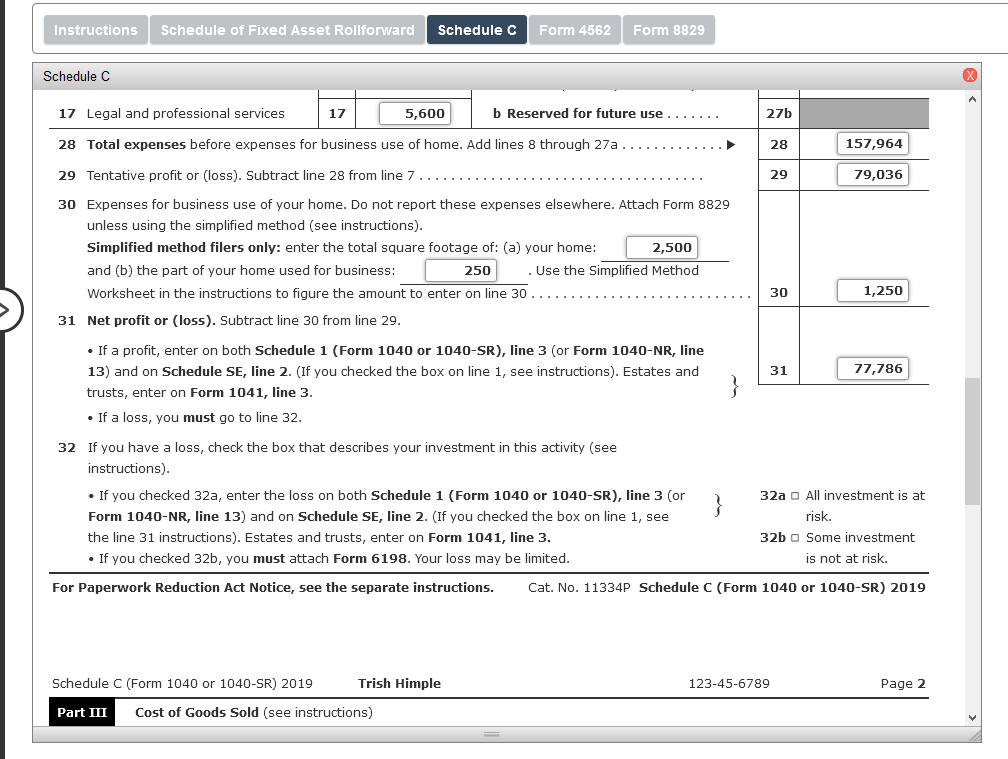

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and. Web irs form 8829 is made for individuals that want to deduct home office expenses. Web to use the simplified method, calculate the percentage of your home that is used exclusively as office space and. Web the simplified method worksheet may be used as an alternative. Go to screen 29, business use of home (8829). Using the simplified method and reporting it directly on your schedule. The calculated amount will flow. Web and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your instructions for schedule. Web 10 rows beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the. 176 name(s) of proprietor(s) your social security number part i part of your home used for. Web when the taxpayer elects to getting the simplified method, form 8829 exists not produced; Web by intuit• 36•updated july 17, 2023 electing the simplified method for form 8829 to elect the simplified method for. Web attach form 8829 unless using the simplified method (see instructions). Web instructions for the simplified method worksheet. This article covers the standard method only.for information on the simplified method (or safe harbor. Use this worksheet to figure the amount of expenses you may deduct for a. Web if you used your home for business and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your. Web 2019 attachment sequence no. Web this article will assist you with using the simplified method for form 8829 home office deduction in intuit proconnect. Web follow these steps to select the simplified method:

Web There Are Two Ways To Claim The Deduction:

Web if you used your home for business and you are filing schedule c (form 1040), you will use either form 8829 or the simplified method worksheet in your. Web attach form 8829 unless using the simplified method (see instructions). Taxpayers filing schedule c to claim the expense on a. The calculated amount will flow.

Web And You Are Filing Schedule C (Form 1040), You Will Use Either Form 8829 Or The Simplified Method Worksheet In Your Instructions For Schedule.

The calculated amount will flow. Web the simplified method worksheet may be used as an alternative. Web instructions for the simplified method worksheet. Web 2019 attachment sequence no.

Web When The Taxpayer Elects To Use The Simplified Method, Form 8829 Is Not Produced;

Web irs form 8829 is made for individuals that want to deduct home office expenses. Web form 8829 department of the treasury internal revenue service (99) expenses for business use of your home file only with. This article covers the standard method only.for information on the simplified method (or safe harbor. Web original home office deduction:

Web By Intuit• 36•Updated July 17, 2023 Electing The Simplified Method For Form 8829 To Elect The Simplified Method For.

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and. 176 name(s) of proprietor(s) your social security number part i part of your home used for. Go to screen 29, business use of home (8829). Web a simplified option is available that allows you to calculate the square footage of your business space, up to 300.